Sliding scale arrangements in FIDIC construction contracts explained (price adjustment)

Last updated: 19 Dec 2025

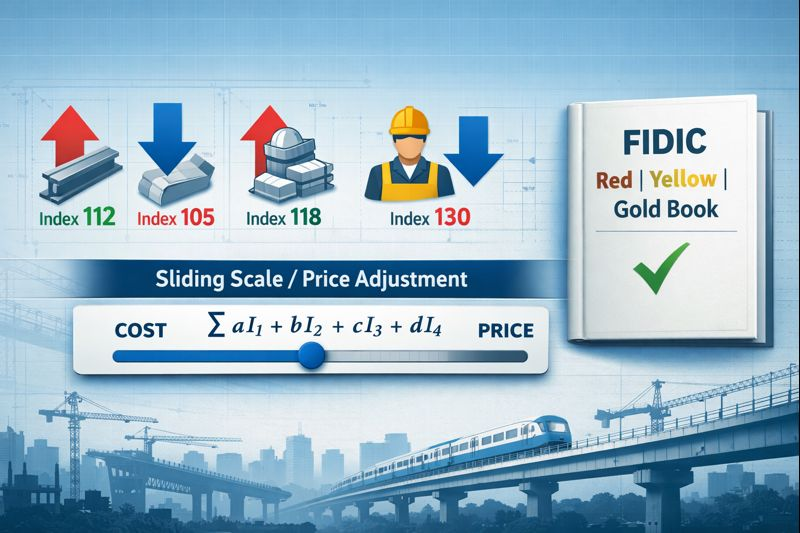

Featured snippet (quick answer): A sliding scale arrangement (also called a price adjustment / escalation mechanism) is a contract pricing method where amounts payable are adjusted up or down using agreed indices and weightings (labour, steel, cement, fuel, etc.) to reflect inflation/deflation during execution—most commonly implemented in FIDIC via Sub-Clause 13.8 (1999) or Sub-Clause 13.7 (2017), provided the contract includes the required adjustment schedules/tables.

1) What “sliding scale arrangement” means in construction contracts

In engineering terms, a sliding scale arrangement is a risk-sharing model for cost volatility:

- The Contractor’s payment “slides” with changes in agreed input costs (labour, materials, energy, plant, etc.).

- Instead of renegotiating rates each time inflation spikes, the contract applies a formula tied to published indices (WPI/CPI/industry indices) and pre-agreed coefficients (“weightings”).

Why it exists

Construction is a long-duration production process with exposure to:

- commodity swings (steel/cement/bitumen)

- wage revisions

- fuel price changes

- supply chain shocks

- currency effects (on imported equipment)

A sliding scale doesn’t eliminate these risks—it allocates them transparently and reduces disputes about “who carries inflation.”2) Sliding scale in FIDIC: where it sits (and when it applies)

FIDIC 1999 (Red Book / Yellow Book concept)

- Sub-Clause 13.8 – Adjustments for Changes in Cost is the escalation/price adjustment mechanism in the 1999 suite.

- It is not automatic. It applies only if the Appendix to Tender includes a completed “table of adjustment data” (or equivalent schedule). If not included, the clause does not apply.

FIDIC 2017 (Red Book / Yellow Book concept)

- The escalation mechanism moved to Sub-Clause 13.7 – Adjustments for Changes in Cost (2017 editions).

- Similarly, if the required Schedule(s) of cost indexation are not included, the sub-clause does not apply.

Related—but different—FIDIC mechanisms you must not confuse with sliding scale

- Change in Laws / legislation is a separate entitlement pathway (2017 Red Book commonly referenced as Sub-Clause 13.6 for changes in laws; older forms used different numbering for legislation adjustments).

- Exceptional Events/force majeure type relief is separate again.

Practical takeaway: A proper sliding scale arrangement in FIDIC is “formula + indices + coefficients + base date + payment timing.” Without those schedules, you’re usually left with only (a) variations, (b) change in law, or (c) exceptional events arguments—each with a higher disputes risk.

3) Types of sliding scale arrangements (from simplest to most robust)

Type A — Full indexation (multi-factor formula)

Best for long-duration civil works with volatile inputs.

- Break the contract price into cost components: labour, steel, cement, fuel, other materials, plant, etc.

- Apply index ratios each interim payment period (monthly/quarterly).

- Often includes a non-adjustable portion (“fixed component”) to cover overheads/profit and non-indexed costs.

Type B — Partial indexation (selected inputs only)

Common when Employer wants limited exposure:

- adjust only steel + cement + bitumen + labour

- leave overheads/other materials as fixed.

Type C — Threshold / banded sliding scale

Adjustments apply only when inflation exceeds a band:

- first 2–3% is contractor risk

- beyond that, shared.

Type D — Cap-and-collar (ceiling and floor)

- Contractor protected from extreme inflation

- Employer protected from unlimited escalation. Useful for budget-constrained public clients.

Type E — Two-way sliding scale (symmetrical)

Adjusts up and down (inflation/deflation). This is cleaner contract economics, but Contractors sometimes resist downward movement unless volumes are stable.

Type F — Hybrid: indexation + “open-book” for nominated imports

actuals (with audit) for imported equipment affected by forex/market shocks.4) How it works technically (FIDIC-style logic)

Core formula concept

A typical indexation formula breaks down as:

ΔP = P × (a + b(I_L/I_L0) + c(I_S/I_S0) + d(I_C/I_C0) + e(I_F/I_F0) + … – 1)

Where:

- P = value of work for the period (or relevant valuation base)

- a = non-adjustable portion

- b, c, d, e… = weightings (coefficients, sum often ~1.0)

- I / I0 = current index vs base index for each input

The “table/schedule” is the contract’s heart

In FIDIC practice, you need:

- Base date/index month

- Indices sources (e.g., WPI series, CPI labour, fuel index)

- Weightings

- Currency split (local/foreign)

- Timing (monthly/quarterly; which month’s index applies to which IPC)

- Exclusions (e.g., cost-plus items, dayworks)

FIDIC itself flags this as an optional mechanism requiring the relevant schedules/tables to be included.

5) Application across FIDIC frameworks: Red, Yellow, Gold

5.1 Red Book (Construction – Employer’s design)

Where sliding scale fits best:

- Heavy civil works, repetitive BOQ items, large labour/material content.

- Measurement-based payments make indexation relatively straightforward.

Typical approach:

- Full or partial indexation applied to measured work values each IPC.

- Special care: if major variations change the cost structure, weightings may become unrealistic—this is a classic dispute trigger.

5.2 Yellow Book (Plant & Design-Build – Contractor design)

Why it’s trickier than Red Book:

- More equipment/procurement risk and often more foreign currency exposure.

- Long-lead items may be ordered early, but installed later—index timing can misalign with actual cash outflow.

Good practice in Yellow Book:

- Separate indices for (a) locally procured materials and (b) imported equipment.

- Align index application to procurement milestones (e.g., on delivery) instead of only “work executed”.

5.3 Gold Book (DBO – Design, Build & Operate)

Sliding scale has two phases:

- Design & Build phase (construction inflation risk)

- Operation phase (O&M inflation risk: energy, labour, consumables)

Gold Book best practice:

- Construction phase: standard indexation as in Red/Yellow logic.

- O&M phase: separate indexation tied to CPI/WPI-energy indices, with clear rules for tariff/availability payments.

6) Advantages and disadvantages (technical + commercial)

Advantages

- Cleaner risk allocation: inflation risk is shared instead of buried inside tender premiums.

- Better bid pricing: Contractors reduce contingency, improving competitiveness.

- Fewer renegotiations: formula-based adjustments reduce ad-hoc claims.

- Bankability: lenders like transparent price adjustment on long projects.

- Lower dispute temperature: when indices are agreed, arguments shift from “entitlement” to “calculation correctness.”

Disadvantages

Delay interaction disputes: when delays are Contractor-caused, contracts often “freeze” indexation or restrict adjustments—this becomes contentious fast.7) Implementation challenges (what actually goes wrong on projects)

Challenge 1 — Wrong coefficients (weightings)

If weightings don’t represent the real cost structure, the mechanism becomes distorted.

Example: Steel weighting set at 5%, but the design evolves to steel-intensive structures via variations. Contractor argues the coefficient should be revisited; Employer resists because it inflates payments.

Challenge 2 — Index source disputes

- Which WPI series? Which base year? What if the government revises the series?

- What if a particular material index is discontinued?

Challenge 3 — Timing and “which month counts”

Monthly IPC but quarterly index publication? Or index is “average of preceding three months” (common in many public forms). Indian EPC templates often specify detailed computation logic and timing.

Challenge 4 — Exclusions (dayworks, cost-plus, nominated subcontractors)

If the contract excludes items valued “at cost”, you must clearly identify them in IPC breakdowns, or the adjustment becomes messy (and auditable).

Challenge 5 — Interaction with extension of time and culpable delay

This is where many “sliding scale” disputes are born:

- Employer says: “Delay is yours; escalation shouldn’t run.”

- Contractor says: “Delays were Employer-risk; indexation must continue.”

Unless your Particular Conditions clearly state freeze rules and the process to decide delay responsibility, you get compounding claims.

8) Real-world Indian examples and parallels

Example 1 — National Highways (MoRTH/NHAI EPC-style price adjustment)

India’s highway EPC model agreements include a detailed “Price adjustment for the Works” clause and define index-based adjustments for key inputs like labour, cement, steel/components, bitumen, fuel and other materials using published indices (WPI, etc.).

Why it matters for FIDIC users in India: If you are delivering a FIDIC-based contract for an Indian authority, the Employer’s finance team often expects this kind of transparent indexation logic because it is familiar in highways.

Example 2 — CPWD-style escalation (Clause 10CC family – public building works)

CPWD/Government-style contracts commonly use formula-based escalation clauses (widely referenced as Clause 10CC in many GCC adaptations), calculating escalation on work done using notified indices and defined rules for what portion of the work is “escalable”.

Useful lesson for FIDIC projects: The CPWD approach is extremely procedural—measurements, indices, and exclusions are spelled out. FIDIC parties who keep the cost-indexation schedule too “high level” often regret it later.

Example 3 — Indian Railways price variation practice

Railway works often include a Price Variation Clause (PVC) with quarterly average indices and defined rules, issued/updated through circulars/corrigenda.

FIDIC crossover point: If your project relies on Railway-standard indices and practices, align your FIDIC cost-indexation schedule to those published references to reduce “index authenticity” disputes.

Example 4 — Disputes seen in Indian courts

Indian court/arbitration commentary repeatedly shows a pattern:

- If the contract includes an escalation mechanism → disputes shift to interpretation and calculation.

- If the contract excludes escalation → tribunals/courts scrutinize whether escalation can still be awarded as damages depending on wording and facts.

Practical implication: In India, sliding scale is not just “commercial”; it becomes a litigation/arbitration issue if your clause is unclear about extended period, culpable delay, or exclusions.9) Best practices for claim management under sliding scale arrangements

9.1 Drafting best practices (before contract signing)

Checklist (put this in your tender/contract review):

- Define Base Date and the exact index month/quarter to use.

- List index sources (publisher, series name, base year, revision rule).

- Provide substitution rule if an index is discontinued.

- State the valuation base (measured work? certified amount? excluding advances/retention?).

- Define exclusions (dayworks, cost-plus, nominated subcontractors, provisional sums).

- Define delay rules: what happens if Time for Completion is exceeded and who decides responsibility (and when).

- Add a worked example in the Particular Conditions annex to avoid “math fights”.

9.2 Administration best practices (during execution)

- Separate IPC lines for adjustable vs non-adjustable items

Make the IPC auditable: one wrong aggregation can destroy months of entitlement. - Create an “index register”

- store published index notifications/PDFs monthly/quarterly

- freeze them in your document control system

- reference them in each IPC calculation

- Automate calculation but lock the logic

Use a protected spreadsheet with: change log, locked formulas, approval workflow. - Handle variations proactively

If variations materially change quantities/cost mix, evaluate whether your coefficients are still reasonable. - Run “shadow calculations”

Employer/Engineer and Contractor should each compute independently and reconcile early—don’t wait for final account.

9.3 Claims strategy when things go wrong

When escalation becomes disputed, structure your submission like an engineering proof:

A) Entitlement

- Point to the exact FIDIC sub-clause (1999 13.8 / 2017 13.7) and confirm the required schedules are included.

- Demonstrate that the valuation base and exclusions were applied per contract.

B) Method

- Show formula, coefficients, index sources, and timing rules.

- Include a worked example (one IPC) and then the full summary table.

C) Evidence

- Published indices copies

- IPC valuation extracts

- measurement sheets

- variation instructions

D) Delay interface

If Employer argues “freeze due to Contractor delay,” isolate:

- the delay responsibility record

- EOT applications

- Engineer’s determinations

- the exact clause language governing index freeze (if any)

10) Practical mini case studies

Case Study 1 — Metro/elevated corridor with steel-heavy scope growth

Scenario: BOQ-based contract begins as typical viaduct work. During execution, Employer instructs design change to heavier steel spans for constructability.

Problem: original coefficient for steel was low (based on initial design). Steel prices rise sharply; Contractor’s indexation recovery is far below actual exposure.

Best-practice response:

- Quantify cost mix shift attributable to variations.

- Submit a structured request to adjust weightings only if your Particular Conditions allow it.

- Avoid double recovery: don’t claim the same impact through both “new rates” and indexation unless the contract permits.

Case Study 2 — Highway EPC with transparent multi-input adjustment

Scenario: Contract includes explicit price adjustment for labour, cement, steel/components, bitumen, fuel and other materials with published indices.

What works well:

- Clear component list and index sources

- Regular computation cycle

- Lower dispute frequency (most disagreements are arithmetic, not entitlement)

Lesson for FIDIC drafting in India: Borrow the clarity of these Indian EPC templates when building your FIDIC cost indexation schedule.

11) Key takeaways

- Sliding scale arrangements are optional in FIDIC but essential for long-duration projects with material cost exposure.

- The devil is in the detail: formula + indices + coefficients + base date + timing. Vague schedules lead to disputes.

- Indian projects benefit from alignment with MoRTH/NHAI and CPWD standard forms because Employers expect transparent indexation.

- Admin discipline is critical: separate IPC lines, index registers, locked spreadsheets, and early reconciliation prevent final account pain.

- Delay interaction is the biggest dispute driver: clarify freeze rules and responsibility decision processes before contract execution.

- Evidence and method matter more than theory: when claiming escalation, present formula + coefficients + indices + worked examples.

Last updated: 19 December 2025

Admin-heavy: indices collection, validation, computation, audits.

Index mismatch risk: published indices may not reflect the Contractor’s actual basket.

Gaming risk: if weightings are poorly set, one party benefits unfairly.

Budget uncertainty for Employer: final outturn cost becomes variable.

Indexation for local inputs